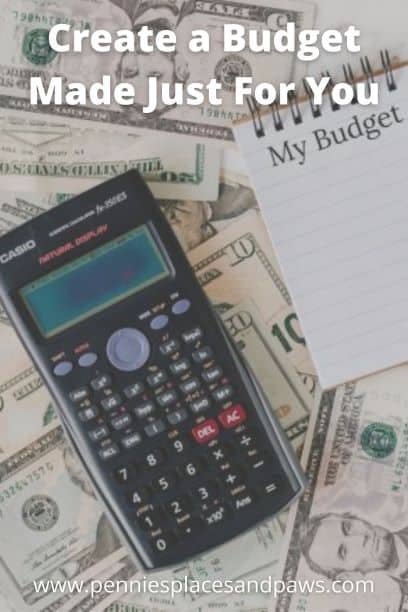

Create a Budget Made Just for You

As an Amazon Associate, I earn from qualifying purchases. We may receive a commission for purchases made through these links. This site also contains affiliate links to products besides Amazon, like Etsy. We may receive a commission for purchases made through those links too (at no additional cost to you).

How to Create a Budget that You Will Stick To

Everyone knows that they should create a budget, but how do you decide what to prioritize or even where to start when you create your own? There are many opinions about what one should and should not do. I believe everyone’s budget should be based on WHY they want to start one in the first place. Find out how to create a budget that works for you so you will be more inclined to stick to it and reach your financial goals. I am not a financial advisor and do not have a financial background, but this method is how I have worked to pay off debt while still squeezing in things, like travel, that are important to me. Before making any type of huge financial decisions, it is always best to speak to a licensed professional.

What is your WHY?

The most important part to creating and implementing a budget, is to figure out your WHY. Why do you want to create a budget or better yet; why is creating a budget important to you now? Do you have debt that you want to pay down? Is there something special you want to save up for? Without keeping track of your finances, does your money seem to disappear? Once you figure out why you want to start to budget, then you can figure out the best budget for you and most importantly be more likely to follow it. You will find that your budget will change as your why changes and this is perfectly ok! As circumstances and your priorities change, take the time to make the adjustments needed to your budget and you will be more likely to stick with it in the long run.

Keep Track

Anyone that knows me is aware of my obsession with lists. I find making lists helps break things down in a more manageable fashion and reminds me of what I am supposed to do. When I budget, I start off by making three lists to keep track of on a whiteboard; bills, savings and debt. Debt is broken down into who and how much is owed. Personally, if I cannot see something, it is hard for me to remember my plan and it is easy for me to go off track. I update the amounts for our savings and debts monthly which helps keep me motivated. Seeing the amount of debt go down and savings up every month reminds me that I am on the right track and helps to prevent unnecessary shopping sprees that would throw me off track. Even better is the elation I feel when I can erase a debt completely from the board.

Monthly Bills

When creating a monthly budget, start with your bills. Put together a list of monthly bills labeled with what they are and the estimated amounts of how much they are. Start with the bills that are the same each month like cable, the mortgage, car, cell phones, etc. Next, take a look at the bills that can fluctuate like your utilities and estimate the maximum amount of how much each of these could be. I group our gas and electric bills together and estimate a total for both since gas is more in winter (heat) but electricity costs more in the summer (A/C). Since the total of the two typically stays about the same, it is easier for me to use this method to allocate the proper amount for these two bills. For your debts, start by writing down the minimum payments for each one.

*Savings Tips*

- If you want to lower the cost of your utility bills there are a few things you can do. For the water bill, cut down the amount or the length of time of your showers. In the spring and summer, cutting down on things like watering your grass will also make a huge difference.

- Change the thermostat a few degrees and instead put on a sweatshirt or open the windows. Just a few degrees will make a nice difference in the amount owed.

- Switch your light bulbs to LED and unplug items that are not in use. These changes will not be as drastic as adjusting your thermostat, but every little bit helps.

Now you have a list of all your monthly bills and an estimated amount for each. I take the additional step and separate them into what paycheck they will get paid from. Ours are separated into the first paycheck of the month and the second because we get paid every other week. And do not forget to plan for the bills that are not monthly like vet bills or car/life insurance if you choose to pay those in full. That way you have time to start setting aside money each month so you can pay them out of pocket.

Once you have your bills separated and the total for each paycheck ready, subtract the amounts from your take home pay. This is the amount of money that you will have to play with and decide how much of it will go to savings, paying off debt, and what gets spent on food, pet and house supplies and anything extra you might want.

Prioritize

Now is the time to decide what your priorities are. Is it more important to pay off your debt, increase your savings, or is there a trip, event, or big purchase that you want? How much money do you need to spend on day to day living? Once you figure out what is most important to you, you can start looking at where the money needs to go.

The most important thing is to figure out how much you need for your day to day living. This means what you would need for food, gas for your car, pet supplies, toiletries, and a small amount for extra activities that may come up each month. This category may be easier to split into smaller sections like groceries and pet care if you need to. Look at the average amount that you spent on these things over the past few months and this will be your starting point as to how much you will need to set aside in your budget for your monthly living expenses. If your goal is to save money or pay off your debt, this is potentially a good place to make some cuts, especially if you have a habit of spending money on more than the bare necessities.

*Savings Tips*

- Try to eat out less by cooking meals at home, bringing meals to work, and limit restaurant outings with friends. In our house, we agreed to only go out once a week for lunch at work and once a week for dinner.

- Increase house hangs with your friends instead of going out to bars. This saves money but still lets you hang out with your friends. When you do go to a bar, have a budget for the outing. My husband and I agreed to a 2-drink purchase maximum and no bar food. This prevents us from having any surprise $100 bar tabs.

- Consolidate your trips to save on gas or choose to walk or bike to your destinations. These are all small steps, but they do add up!

Make Room for What Matters

It is important that you still make sure you leave room for fun and enjoyment. Leave room for what matters most to you. Our friends go out ALOT, so we made sure to include a meal our two out a week in our budget so it was easier to stick to the game plan. It also helped hosting game nights and such at home, so we still felt like a part of the group.

Travel is also important to me because it has a huge effect on my mental health. I put together numerous trip itineraries and calculate how much each trip will cost. We plan our vacations around whether we have (and can afford) a pet sitter and how much the trip will cost. This means that some years we go to Universal or overseas, and some years it is mostly day trips to surrounding areas depending on how much money we have available. Figure out what you ‘need’ to make you happy and try to find a way to work it in the budget. This will also help make sure you stick to the plan.

*Savings Tips*

- You can use the money earned from credit card points to help pay for some of your ‘extras’. My 3-day birthday trip to Kentucky last year was paid completely this way.

Time to Save

Now it is time to determine how much money will go into savings each month or paycheck. When your paycheck comes in, transfer the money out right away or have it taken out automatically. This will help make sure that you do not spend it on something else. 2020 has taught all of us the importance in having a savings account to fall back on.

Pay Off Debt

Finally, if you have debt, you need decide how and what debts to pay off first. Everyone has an opinion on this. To save the most money of course, you pay off the debt with the highest interest rate. I believe that the order should be tied to what motivates you more. I am a ‘cross it off my list’ person. If I have a list of debt and I am not able to cross anything off it for years, I become defeated and it usually results in me falling off the budget wagon.

When I started becoming serious about paying off my debt, I had 10+ different debts that I had to pay off at any given time due to pure bad luck and having no savings. I had accounts with several car repair places, best buy (computer needed for school), and credit cards that helped with more car repairs and keeping me fed. I had a car payment, and at one point 2 student loans that I had taken out to cover not being able to work for a few months because of a bad car accident. I did not think I would ever get out of debt (my career choice paid poorly) but I kept trying.

I prioritized paying off the amounts that had the least owed at the beginning. It may not have saved me the most money in the long run, but I was able to erase debts off my list which made me feel great and kept me motivated to keep going.

Another thing to look at is to see what would make the biggest difference in monthly bills. If the minimum payment is $75 for one, but $500 on another, it would help the most to eliminate the $500 monthly bill. This is what we are doing with our last two debts. Now that we are down to one consistent income, having an extra $500 a month would make a gigantic difference. So, in this case, we are paying the bigger debt off first to free up more money each month.

Decide what will keep you the most motivated and make your plan to pay off your debt from there. Do not forget those special interest loans and credit cards. Make sure you are paying the minimum payment to ensure the total is paid off in the specified time. If you do not pay them off in time, the penalties are huge with the back interest rates that they add on. You can also consider taking advantage of the ‘no interest for a year’ credit card transfer deals. If after the year is up, the interest rate is higher than what the debt currently has, only transfer what you can pay off in that years’ time. This method can help speed up the process of paying things off by saving money on the interest that accrues. You do have to pay attention to any extra fees and special rules to make sure that it will in fact save you money.

Budgeting is a Long Game

Budgeting is not fun, but I cannot stress how important it is. Dave Ramsey said, “Live like no one else now, so you can live like no one else later” and this is something that I wholeheartedly agree with. We may not go on as many trips or out to eat as much as some of our friends, but we have been able to do other things that they have not been able to do. By prioritizing paying off debt and living within our means, we have been able to weather many a financial storm from surprise surgeries to having the freedom to quit a job in an unhealthy work environment. There will be unexpected expenses that come up but just remember to be flexible. Budgeting and paying down debt are a long game, but you can do it!

Do you have any budget tips? If you have any questions or need encouraging commentary feel free to drop a line!

Pin For Later:

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.

Such a helpful blog post. I’ve never been good at sticking to a budget, but I think the point on tracking everything would be helpful.

Thanks! I do find that tracking how much I typically spend helps me to make realistic budget amounts- otherwise I am way off in what I actually am capable of meeting. Especially if I am trying to cut my spending! LOL

Great read. Many years ago when I taught middle school aged children, I spent a week teaching them budgeting. It is never too young to learn.

Great tips and advice to start the new year off right! Budgeting can be difficult in the beginning but once you get used to it… it makes life so much easier!

It really does!

I’m a list maker too! Nothing like checking or crossing things off. I like your points to make small changes around the home to save money. I’m going to start unplugging things that aren’t in regular use.

Love to fellow list makers!

Great ideas! I love making lists. One think we found is having another savings account where it’s not easily accessible to pull money out. That way we don’t just keep spending on non essential things.

Love it! We have two savings accounts and one we never touch because we are too lazy to figure out where the atms and such are! LOL

Great read. We have 4 boys so planning and sticking on our budget is so important.

I am a firm believer in living on a budget. I use a spreadsheet for our budget. I love being able to change things in real-time like moving money from the grocery budget to the credit card I used to pay for it. That way we always know exactly what we have and what it is designated for. After both of us losing our jobs, it has been a life-saver.

Great tips! I have an Excel spreadsheet for my budget. I keep track of all our expenses, and add in our paychecks every two weeks. It’s definitely helpful to see what money we have, and what it is allocated to!

Thanks, very helpful and something we should all do.

Having a plan for your money (or anything else) is so necessary to keep us on track. Good tips!

January is always a great time to reflect and do better for the coming year. I appreciate all your tips and helpful suggestions!

I was just speaking to two of my Gfs about creating a budget/financial goal list. I am definitely sending this to them haha. Great info.

Thanks for the shares!

I live by my budget. It has helped us to weather all kinds of storms. Thanks for sharing.

Great suggestions! Budgeting is so important to maintaining financial health.

I love budgeting! There are so many ways to make your money work harder for you!

Making a budget and sticking to it is so helpful, especially if you tend to make lots of little purchases each day that really add up over time (I’ve been so guilty of that). Love your tip on making room for what matters – knowing that there’s room in the budget for favorite activities makes it so much easier to follow!

I appreciate your point about being realistic and budgeting for activities you just know will happen. We also like to eat out (ordering take out and trying food from new restaurants is really keeping us sane during the pandemic!) so taking that into account for our budget is key. When we don’t it just feels like a failure that we overspent. Thanks for sharing!

When I started, I wasn’t realistic and felt like a failure when I went over on things like groceries or gas. This was a huge needed step for me to add to my budgeting.

This is really great to consider. Yes, being realistic and budgeting is paramount!

A lot of good tips. Living within your means and paying off debt will give you financial freedom.

I just made my budget for the month of January! After completing Financial Peace University, we’ve kept a monthly budget. The problem is that we aren’t always great at sticking to it. But at least we aren’t paying off debt anymore. And we have an emergency fund which is comforting. All that was possible because of monthly budgeting!

Congrats on paying off your debt! That is huge!!!

You are so right!! Finding your WHY is so important! When my husband suggested a budgeting plan to get us out of debt, at first I was like a two year old toddler throwing a tantrum. But once I discovered my why, what are our goals, and so on, the Budgeting got easier. It’s almost like a game every month, to see how much we can save. Thank you for all the great tips!!

It makes it so much easier to know and want what you are working towards 🙂

I don’t know why I hadn’t thought about actually unplugging items instead of just turning them off. Great suggestions!

Thanks! For the longest time I didn’t realize that even having things plugged in pulled from our electricity 🙂

Great finance tips! We’re looking forward to tackling our debt this year!

This is such a great list with so many useful tips and tricks. I’m so bad in planning and sticking to a budget list so I will take your advice, I’ll need it 🙂

Great ideas! I need to definitely do some auditing and budgeting this week!

Lots of useful tips and tricks! We do a lot of the things you mentioned, and it works! This year I am putting together a budget so I can pay off my car quickly… and travel if we can!

Thanks! You can do it!!!!!

Making meals at home has been such a money saver for my family! I so appreciate this post, my husband and I are doing our best to pay off debt by close of this year.

Excellent advice!

Put getting out of debt as your top priority, and someday you’ll be sitting pretty.

I remember all the struggles we had as a single income family – I was so happy to be a stay at home mom – but now, I’m retired, with zero debt and barely any expenses (since travel has been off the table this year for the most part).

These are great tips for budgeting; I didn’t realize how much of an energy difference it can make by lowering your thermostat by a degree or two!

This was shocking to me too! Especially with our heat bill!!!

Great tips! My husband and I plan to pay off my vehicle this year and then we only have the mortgage with about six years left on it! It’s exciting to see like at the end of the loans!

That’s so exciting!!!! Congratulations!!

Money stresses me out SO much! I appreciate your tips. Perfect time of year to start fresh.

Great post with helpful info. A list maker here too 🙂

Great post! Sticking to a budget is hard for some people, but tackling it step-by-step can be helpful and manageable.

These are wonderful tips! I love that you begin with your big Why.

I love your tips. Saving on energy bills really is just small, simple changes!

Thanks! It can really add up!!