Dog Insurance: A Simple Way to Protect Your Furry Family Member or a Total Scam?

Is Dog Insurance Worth It?

As dog parents, we want to do everything we can to help our pups live long, healthy, and happy lives. As I’m sure you know, proper vet care is a huge and expensive part of that. As vet prices increase along with the cost of living, more and more companies are offering a potential fix: pet insurance. This is causing many dog owners to ask one huge question, is dog insurance worth it?

Unfortunately, the answer to this question (especially if you are on a budget) isn’t a simple yes or no. Get ready, because I’m going to break down the pros and cons of getting pet insurance for your dog, what to look for when researching policies, and other alternatives when getting insurance may not be the best option for your family.

These topics are all things my husband and I consider when we discuss whether getting or keeping an insurance policy for our dogs is the best move.

What is Dog Insurance?

The idea behind pet insurance is to help lessen the financial strain when your animal needs veterinary care. It might be easier to think of dog insurance kinda like health insurance. Basically, pet insurance can partially or totally cover certain medical treatments for your pet. Depending on the policy you choose, this could help with anything from emergency visits to routine care.

Like your personal health insurance, it is super important to pay attention to the details in a policy so you know ahead of time what will actually be covered BEFORE you go to the vet. With a growing number of companies offering pet insurance, different policy options, and the small print, it’s hard to know what to choose or if pet insurance is all just a huge scam.

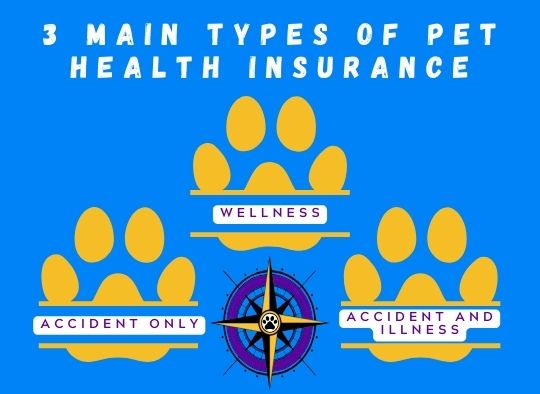

What Are the Main Types of Dog Insurance?

When you start looking at dog insurance policies, it’s important to go into it knowing what the basic types of plans are so you can choose the one that will work best for your situation. To make this part as simple as possible, there are three main types of pet insurance: accident only, accident and illness, and wellness.

As you can probably guess ‘accident only’ policies will ONLY cover your pup’s accidents. This policy would kick in for situations like if your dog gets injured, accidentally ingests a toy or something toxic, etc.

If you choose ‘accident and illness,’ your policy will cover accidents like those above AND cover most treatments for diseases that your dog is diagnosed with like cancer.

The last basic type of dog insurance policy is ‘wellness’ pet insurance, This one covers routine pet care like annual exams, vaccines, and possibly even heartworm or flea/tick treatments.

If you are planning a vacation, you should know that a growing number of companies are expanding into travel insurance for pets. They typically offer optional add-on bundles that can cover pet care costs no matter if your pet stays home or travels with you.

Things to Consider When Choosing Dog Insurance:

It would be so easy to decide what pet insurance policy to pick (if any,) if you only had to worry about choosing between the 3 main types of insurance. Like most things nowadays- it’s not that easy. There are MANY other things you should consider and research before making your final decision.

For a quick summary, you should always check the fine print to discover what will be covered, the deductible, reimbursement percentage/reimbursement schedule, total premium, and the waiting period. In this section, we will go over these things in more detail.

Find Out What Your Dog Insurance Will Cover

When deciding on pet insurance for your dog, find out EXACTLY what will be covered. This is especially true when you’re deciding to insure an older pet or one with medical issues. Most companies won’t cover pre-existing conditions which makes it difficult to find a policy that is worth it if you are knowingly adopting a dog that has special medical needs.

You should also look for any clauses that prohibit coverage based on particular breeds. When researching insurance policies for our latest puppy, I noticed some companies would refuse to cover common hereditary diseases for certain breeds because they happen frequently.

Simply put, if you are looking into getting insurance because your dog’s breed is at high risk for something, or to help pay for a pre-existing condition, it may not be worth getting dog insurance.

If you are considering a wellness plan, be aware that many have limits on what they will reimburse you for throughout the year. Make sure to take some time to calculate whether it would save you any money at all before you sign up.

Most wellness plans we looked at weren’t worth it after we added up the monthly premiums and the percentage we would be responsible for compared to what the vet appointment actually cost. If our puppy had needed to be neutered and vaccinated, then it would have been worth us buying it for the year.

Pet Insurance Reimbursement Schedules, Limits, and Deductibles

The details around reimbursement cover everything from how to file your claim to how much and how long it will take to get your money back. With most policies, you will have to pay the entirety of your vet bill upfront. After your claim is processed, they will send you a check to cover the amount you will get reimbursed for.

Some policies have an annual cap on the total amount they will reimburse and other policies limit you to a percentage of each transaction after your deductible. Your deductible is the set amount you pay for every claim filed that you will NEVER be reimbursed for.

Check The Total Premium of The Insurance Policy

Make sure you verify what your total premium (what you pay to have dog insurance) will be every year. The insurance companies will calculate this amount based on your dog’s age, breed, location, deductible, and what coverage you choose. Some companies will also make adjustments based on how many claims you have submitted to them, and it’s important to note that most will also slowly raise your rates as your dog gets older.

Know the Waiting Period for Your Pet Insurance

Most insurance policies will have waiting periods listed in their fine print. This is to prevent pet owners from rushing to get insurance after their pet starts showing signs of injury or illness but before they are seen and billed for a vet visit.

These waiting periods vary depending on your pet’s potential issues and diagnosis. Sudden accidents are usually covered instantly, however, things like joint issues could have up to a 6–12-month hold. This would mean that any joint issue found before your waiting period is up might not be covered.

So, Is Dog Insurance Worth It?

Now that we’ve gone over all the factors that influence what and how much pet insurance will ultimately cover, you’re probably even more confused about whether dog insurance is worth having. To help you decide, I’m going to break down both the pros and cons of dog insurance, and then we’ll get into what you should look at more specifically before taking the final leap.

Pros of Dog Insurance

The right kind of dog insurance will provide financial security and bring you peace of mind. If something happens to your dog, you know that most of the care they will need at the vet is covered. Not having to stress about the financial side of pet care is a huge benefit. If your pup gets injured or sick, you’ll have enough to worry about because you want your pet to feel better.

Worrying about how to come up with the money at the last minute so that your dog can get help is a stress that no pet owner should have to deal with. Proper dog insurance means that you can make treatment decisions based on what is best for your pup instead of what you can afford on the spot.

This often means you can provide a higher level of care BECAUSE you aren’t as restricted financially. It can even help you catch issues early on because you can afford whatever test that your vet recommends.

Cons of Dog Insurance

The downside of dog insurance is that you are paying for something that you may rarely or possibly never use. Between the deductibles and monthly or annual premiums, you could end up paying more with insurance than you would without it. Combine this with the fact that not everything may be covered (check that small print!) and you could end up feeling like buying pet insurance was a huge scam.

Another huge downside of pet insurance is that you must pay the money for your appointments up front and wait to be reimbursed. This means that even though you will get the money back eventually, you still have to find a way to initially cover the complete cost of your vet appointment.

How to Decide Whether You Should Get Dog Insurance:

Ultimately the decision of whether you should purchase dog insurance will be up to you and your unique circumstances. I suggest looking at the average cost of vet care where you live and comparing it to the estimated cost of the policy you are looking at.

If you believe your pet has a low risk for illness or injury AND the cost of vet care in your area is low, it might be better to avoid getting a policy and look into other options instead. However, if your dog is a puppy or tends to be accident-prone, you may save hundreds or thousands of dollars by getting a pet insurance policy each year.

Either way, dog insurance is a gamble in the long run. It’s up to you to decide whether you’d rather risk paying for a policy that you may not use, or not have a policy and pay everything out of pocket if your pet gets sick or injured.

Finding the Right Dog Insurance for You:

If you’ve made the decision to get your dog on a pet insurance plan, you then have to decide which plan to choose. First, you’ll want to decide what type of insurance you want: accident, accident and illness, and/or wellness. This will depend on your finances and your main concerns regarding your pet, not to mention their age, breed, personality, and health history.

Wellness insurance can be helpful if you want help budgeting for your regular appointments. The difference between ‘accident’ insurance and ‘accident and illness’ is completely dependent on what you think is best for your dog and pocketbook. Usually, the price difference between the two plans isn’t that different, so it may make sense to get more coverage.

Make sure to take the time to research different insurance companies and compare quotes. Read the reviews and look over the claims process, reimbursement schedules, and individual policies. You’ll find each company will have price and coverage differences, so take the time to read the small print so you can get what you need and have no surprises.

How to Save Money on Dog Insurance

Since the main reason to get insurance is for financial help, you want to make sure you know how to save money on your dog insurance policy. The simplest way to save on your insurance premium is by adjusting the amount of your deductible. The bigger the deductible, the less your premium will be. Just make sure your deductible is an amount you can afford in case of an emergency.

Another good way to save is by bundling your insurance policies. Check to see if your car, house, or rental insurance company also offers pet insurance. Some large companies offer pet insurance through a smaller off-shoot company. And they can sometimes be cheaper than the companies that only sell pet insurance.

Just like the commercials say, the more you bundle, the more you save. We were able to get the best rate by purchasing our puppy’s insurance policy with the same company that carries our car insurance.

Remember to keep an eye on the cost of your policy premiums each renewal period and consider switching companies or even dropping your dog insurance if it gets too high. Most companies will raise your rates as your pup ages and some companies will even raise your rates depending on how many claims you have file.

Alternatives to Pet Insurance

If the cost of pet insurance doesn’t seem worth it to you, there are still other ways you can prepare for emergency vet bills. One way is that instead of getting a wellness policy, you could start a savings account specifically for your animals. If you decide to do this, I recommend putting together an estimate of what it would cost you for a full year of vet care.

Your estimate should include your dog’s regular vet appointments, vaccinations, and any other medications or supplements your dog would need like heartworm or flea and tick meds. Divide this total amount by 12, and that’s what you need to put aside every month to cover your normal vet care costs.

Don’t forget to check out our post for ideas on how to help you save money on vet care.

In place of illness or accident insurance, look at your overall finances and commit to setting aside a fixed amount in case of emergency. You can take the quotes you were given for a monthly premium or what you had been paying for pet insurance and put that amount into a savings account. This way, you will have a substantial amount of money saved to cover those costs when and if a vet emergency comes up.

Another option to help with surprise animal care bills is to open a line of credit specifically for vet care. Care Credit is one of the more popular companies that have this option. Companies like this will typically offer instant approval and most have 0% interest options as long as you can pay it back within a set time frame.

Be careful with these programs because they can be sneaky with their 0% interest deals. If you don’t pay the full amount back on time, they will charge you back-interest on the amount of the original purchase. More importantly, if you use your card outside of the 0% interest deal, they will apply your payments to those purchases UNLESS you specify that you want it to go towards the promotional amount first. This policy makes it more difficult to pay off your special offer on time which often results in higher fees.

Even if you decide to get or keep your pet insurance, these methods can still help you cover the initial cost of your pet’s appointments and treatments until you get reimbursed by the company.

Our History with Pet Insurance

You may be wondering what experience I have with pet insurance and if it’s enough for you to justify listening to my opinion on the topic. Even though, I didn’t get pet insurance when it was first offered in the USA (fun fact that it was by Veterinary Pet Insurance or V.P.I. in 1982) however, V.P.I. WAS the insurance company we used for our first dog insurance policy back around 2014.

When we lived in Miami Florida, we held policies on three out of four dogs for several years. My oldest dog Remington had multiple pre-existing conditions that wouldn’t be covered and the monthly premiums due to his age were too high for us to justify buying it since most issues wouldn’t be covered.

During that time, we did carry pet insurance on our other three dogs while we lived in Miami, Florida mostly because our area had very high vet fees. We were fortunate enough to only have to use it on our husky. She had a bad habit during her puppy years of eating things she wasn’t supposed to and eating too quickly which resulted in multiple emergency vet visits. Having her insured saved us thousands of dollars during this stage in her life.

As our dogs continued to age, their insurance premiums started going up exponentially. We also ended up moving to Ohio where vet care is much less expensive. After looking at how much we would have to pay in premiums and deductibles compared to the cost of emergency vet visits in our new state, we decided to drop our dogs’ insurance policies.

Our original plan was to put what we would have paid for their insurance policies into a savings account for vet visits but unfortunately, we weren’t consistent with it. If we had done this, it would have helped immensely when our two oldest dogs got sick in their final years with us or when our husky tore her ACL and needed surgery. Since then, we have started putting money into an account just for vet bills every month.

So, do we regret canceling our dog insurance policies? Honestly, not really but I’ll break it down case by case.

The total cost for the ACL surgery and medications was about the same we would have paid over the years for a policy for our husky, Emma. Keeping her on dog insurance after we moved would have helped with the sudden extra financial burden, but looking at the costs over time it’s a toss-up on whether it would have saved us money.

Our oldest dog, Remington, never had dog insurance due to his pre-existing condition. He ended up with kidney disease which would actually have been covered since it wasn’t one of his pre-existing conditions. By my calculation, the high cost of his premium due to his age would have been more than what we paid for his treatment- though to be fair we did most of his treatments at home thanks to our animal care background.

Kiara was another dog that we had stopped carrying an insurance policy on. She ended up getting oral cancer and, in this case, the costs of her treatments were more than what we would have spent maintaining her policy over the years. However, I’m not sure if there would have been restrictions on what they would have covered with her treatments and surgery.

The other dog we used to have insurance on, Charlie, has yet to have been in a situation where we could have used it. Fingers crossed it stays this way!

We did recently purchase a dog insurance policy for our newest puppy, Francis, and plan to keep it for at least the first few years of his life. Puppies are known for testing boundaries, exploring the world with their mouths, and getting into trouble in general.

Since Francis IS a puppy, he is more likely to need emergency care in the first few years of his life and we prefer to have dog insurance as a financial safety net as we get to know his personality more and his body finishes developing. Once we know if he has developed any issues, illness, or dangerous habits, the plan is to reassess whether or not we should keep him on an insurance plan or switch over to a savings account for him.

Are You Ready for Dog Insurance?

As you can see, deciding whether to get pet insurance for your dog isn’t as straightforward as it seems. To make the best decision for your household, you need to consider your financial situation, your dog’s age, breed, health history, and personality as well as your comfort level. You should also ask yourself questions like ‘How easily would I be able to come up with money for an emergency vet visit?’ Or, ‘How affordable is vet care where I live?’

If you decide to get a dog insurance policy, then you’ll need to take the time to research so you can choose a reputable company and find a policy that fits your needs. Don’t forget that even with pet insurance, you will still need to pay for the treatment upfront. The main difference is that with pet insurance, you will get most of your money back when you get reimbursed for your claim.

So, is pet insurance worth it? Unfortunately, only time will tell. The real question is, do you feel lucky this year?