Travel Insurance for Dogs

Adding Travel Insurance for Pets

Travel Insurance is becoming increasingly popular (and necessary) as more and more people see the need to plan for the unknowns that can pop up before and during vacation. There are so many companies and plans to choose from depending on where you are going, the length of time you’ll be gone, what activities you have planned, and who you will be going with.

As a dog and ferret mom, I am SOOO excited to see that some companies have finally begun to offer travel insurance for dogs and other pets! Selecting a good pet insurance policy to help with everyday life is great. But being able to add on bundles that cover travel insurance for our animals is a game-changer and I hope to see more and more options available so pet owners can get more peace of mind.

Since travel insurance for pets (and travel insurance in general) is a relatively new subject for many of us, I’ve brought in an expert to help unravel some of the mysteries around these newer insurance options. In our site’s first guest post, Chelsea from Travel Insurance Master will be breaking down why we should all at least consider getting travel insurance for future trips AND give us some details about a great add-on pet bundle option for pet parents.

For more help planning a dog-friendly vacation, take a look at our Tips for Taking Your Dog on Vacation.

*For full disclosure, I am an affiliate of Travel Insurance Master and may earn a small commission on any purchases through our links*

Travel Insurance for You and Your Pet

By Chelsea from Travel Insurance Master

Your travel budget must include a lot – from your own itinerary to your furry friends’ staycation at home or adventure alongside you. Travel insurance may be the last thing you want to worry about or include in your budget, but it’s an important part of every trip! The relatively small cost you’ll put towards insurance can prove to be an invaluable purchase that will protect yourself and your pet too!

Why and When Should I Get Travel Insurance?

If the last few years have proven anything, it’s the importance of protecting your trip against the unexpected. On any trip that takes you 100 miles or more from home, including domestic trips, and road trips too, travel insurance is a smart purchase. You’ll be happy to learn the cost is even lower when you are not traveling internationally! If you do plan on leaving the States though, you will want to ensure you protect your investment of time and money too.

Travel Insurance Master

Travel Insurance Master partners with the top travel insurance providers to bring a large variety of plans and benefits to one website. In just three steps, you’ll be able to request a quote and find your recommended plan and best value for your next trip, as well as view side-by-side comparisons.

Types of Travel Insurance

There are two main types of travel insurance to choose from. Comprehensive Plans or plans with trip cancelation and travel medical options are the most popular plan type.

Trip Cancellation

Trip Cancellation gives you the ability to cancel your trip before it starts for 100% of your otherwise non-refundable prepaid trip costs. The covered reasons for Trip Cancellation are covered in your plan’s certificate and are most commonly due to sudden illness or injury preventing you from taking a trip.

If you request a quote and purchase a plan early, usually within 1-21 days of the initial trip deposit, you may be able to purchase the Cancel for Any Reason (CFAR) benefit with your plan as well. Although these plans usually cost the most, they give you the most flexibility. CFAR plans allow you to do just that, cancel for any reason whatsoever usually up to 2 days prior to departure for up to 75% reimbursement of your trip cost, or your prepaid and non-refundable expenses.

Travel Medical Coverage

Travel medical coverage is an invaluable resource while you travel domestically or internationally. Many travelers do not realize that their regular health insurance may only provide very limited or no coverage at all outside their home country. If there’s little time before your trip and you do not think there is a chance of trip cancellation, you can filter by No Trip Cancellation on TravelinsuranceMaster.com and find a Travel Medical Plan at a fraction of the price of a Comprehensive Plan. Some of these Travel Medical Plans even provide coverage for trip interruption and delays, baggage protection, and more.

AIG Pet Bundle: Dog Travel Insurance

One of their providers, AIG Travel Guard offers a Pet Bundle option with some of their plans. It adds a variety of benefits for your furry friend, including an additional Trip Cancellation & Trip Interruption benefit due to a critical condition or death of a domestic dog or cat.

Dog Travel Insurance: Pet Care

This Pet Bundle also includes Pet Care for up to $100 per day, to a maximum of $500. This benefit applies if you have placed your pet in a kennel for the duration of the trip, or you have pre-arranged in-home care for your pet for the duration of the trip. The insurance company will pay a benefit to reimburse you up to the maximum limit to cover the necessary additional kennel fees, or additional in-home care fees, if you are delayed past your scheduled return date for at least 12 hours while en route to your Return Destination, due to any of the reasons listed under Trip Cancellation, Trip Interruption, or Trip Delay. See your plan for covered reasons and details.

Dog Travel Insurance: Vet Care

As the owner of a furry friend, you know that medical expenses can be costly for them too! The Pet or Service Animal Travel Medical Expense Benefit is part of the Pet Bundle offered with some AIG Plans on Travel InsuranceMaster.com. The Pet Bundle adds the Pet or Service Animal Medical Expense Benefit up to $2,500, with a deductible of $100. Covered expenses can include medically necessary services of a physician, animal emergency clinic charges, and X-rays.

Be sure to review your plan certificate for details and exclusions. It’s important to note that among other exclusions, routine care, care or treatment which is not medically necessary, and pre-existing conditions are not covered. If the medical expense is covered, your plan may pay a benefit to reimburse you for the Reasonable and Customary Charges, up to the maximum limit shown in the Schedule or Declarations Page (and after satisfaction of the Deductible) if, while on a trip, your pet or service animal traveling with you suffers a sickness or an injury that requires them to be treated by a Physician. Initial treatment by a physician must occur during the trip.

Ready to start planning?

Whether your furry friend is traveling with you or staying home, you will want to protect your trip at TravelInsuranceMaster.com. It’s never too early to start shopping for travel insurance either. As soon as you put down your initial trip deposit, even if you have not paid for your trip in full yet, you can still request a quote and purchase travel insurance.

With Travel Insurance Master, all you’ll need to do is input your trip and traveler details in just easy 3 steps, and you’ll quickly find your recommended plan. Filter by the benefits most important to you on the left-hand side and compare plans from the leading providers.

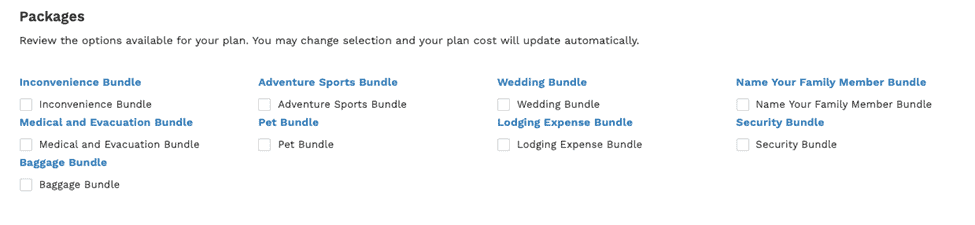

For the Pet Bundle, look for select AIG plans, click Buy Plan and add the Pet Bundle from the Packages section of the purchase page where available. The plan cost will automatically update and then you can complete your purchase! You’ll receive your plan straight to your email, so you can get back to planning and ultimately enjoying your next adventure with your friends or family – pets included!

Pin For Later:

Having additional medical coverage when traveling outside the country is so important, especially with covid still in the picture. When you find yourself in a situation where you need coverage, it’s essential to have it because you can’t go back in time and buy it after you need it.

It really is! Especially when there are so many loopholes in medical insurance, to begin with!

I honestly wouldn’t have thought about pet insurance, but it totally makes sense. Especially if you are a frequent traveler with an animal, this would be something to seriously consider investing in.

This will definitely be incredibly helpful for us in the future 🙂

This is the first I’ve heard of travel insurance for pets, but it totally makes sense. It’s something I should definitely consider at some point, especially with ferrets being as mischievous as they are 😂

LOL, totally!!! (as my ferrets are running around crazily and trying to steal my Fitbit that was charging)

so cool that this is becoming a thing!

I am so excited about these options becoming available!

I had no idea this was a thing – thanks for the info!

My pleasure!

Who knew you could get travel insurance for your pet. Learn something new every day – thanks for sharing.

I learned about it recently and am so excited about it 🙂

This is great information. I never knew this existed for pets. I can see how it would provide next level reassurance for a pet owner. Making sure your pet will be taken care of without a huge bill is a game changer.

Me either! I love how it even covers extra boarding if you get delayed and can’t get home in time.

I hadn’t really thought about pet insurance before your post. But I supposed if I brought my dog with me, and something happened, and I couldn’t care for him, I’d need help watching him, so it makes sense!

I never thought about it either until I heard about it from someone else. 🙂 It kicks in and helps cover your pet sitter or boarding if you are delayed getting home too!

Interesting concept. I would never have thought about pet travel insurance!

I didn’t know this was a thing but it makes perfect sense for those who travel with their fur babies!

I am on the fence about travel insurance. With all the traveling we do, we have only encountered one instance where we lost our on a night in a hotel. It wasn’t fun losing that money, but I’m not sure car trouble would have even been covered.

I think it depends on what travel insurance you purchase. On the more expensive trips, I feel like it is worth it, especially with all of the delayed and cancelled flights and car rentals lately